Ask virtually any advisor how the risk of an investment is measured, and you’ll likely hear them talk about volatility, mean variance, or standard deviation. I know. I’ve done it myself – and still do. All those terms really refer to is simple price fluctuation around an average.

Most investors don’t like uncertainty, which is a kind of oxymoron since the very essence of investing is uncertainty. After all, if you want certainty you can buy a Treasury bill. Unfortunately, the only thing certain about the Treasury may be certain loss of purchasing power after inflation and taxes; but, I digress.

So, even though we know that price fluctuations come with the territory, instinctively, we want to reduce that volatility as much as possible. If a portfolio is expected to provide a given return over the long term, we want as little deviation from that average as possible. And, since the measure of that variance is called ‘standard deviation’, we want the lowest standard deviation we can obtain.

That’s called ‘optimizing’ a portfolio: Achieving the best return we can for the amount of risk we’re willing to take. The risk, of course, reduces return – something we all instinctively know.

Loss aversion is normally the top priority for most investors who are about to retire. Too often, however, it’s the only thing they care about; and those ‘blinders’ can cause real problems.

Is a lower standard deviation always the best choice? Suppose, given an investor’s portfolio size and spending desires, s/he really needs a higher return to achieve their goals!

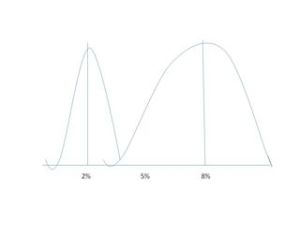

Let’s take a look at my rather crude free-hand drawing of a couple of purely hypothetical bell-curves (I never did attend that art school I used to see advertised inside match books).

These two bell-curves don’t represent any investment or portfolio. These bell curves represent two hypothetical portfolios along a return scale.

We’ll pretend tne portfolio averages a 2% return and the other averages 8%. Each curve, of course, represents the number of return observations around the average for each investment. As you can see the portfolio on the left has a narrower curve, meaning that the variance around the average is smaller. The portfolio on the right has a much wider variance, i.e. more price fluctuation around the average.

An investor focused on only reducing risk would rather be in the lower deviation portfolio. But, what if this investor needed a higher return to achieve his or her goals?

The investor might say, “I don’t want that much risk?” But, if the lower risk portfolio won’t allow the investor to achieve his/her goals, there are only two options: (1) take on a portfolio with increased volatility, or (2) reduce the goals in the plan.

“I looked in the mirror and saw what I didn’t want to see. It was a bad day.”

– Marie Osmand

So, how do we deal with this? Many advisors have begun touting a “bucket” strategy, which refers to earmarking certain investments for certain goals in various ‘time’ buckets (sometimes the strategy also helps sell a prepackaged investment product). The problem, of course, is that each year or so, as time goes by, dollars have to be shifted from one bucket to another simply because each given goal is now closer in time. This can create unnecessary cost and, in a taxable account, some issues at tax time.

The particular strategy chosen can vary based on an investor’s financial and personal profile and is best discussed with a qualified planner. The important point here is that the risk you assume may be the one you have to assume, if you’re not prepared to make other adjustments. By the same token, making the right adjustments may be the best first answer.

Jim

How much risk is in YOUR current portfolio? If your retirement portfolio is over $500,000, you can take the first step in learning your risk number and schedule a 15-minute introductory call using IFG’s convenient scheduler.

RESOURCES:

Jim’s Social Security Learning Center

A Financial Conversation Checklist (does not require registration)

IFG’s Financial Resources website.

Follow Jim on Twitter: @JimLorenzen

Jim on LinkedIn

Become an IFG client! Don’t play phone-tag; schedule your 15-minute introductory phone call using this convenient scheduler!

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® in his 21st year of private practice as Founding Principal of The Independent Financial Group, a fee-only registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. IFG helps specializes in crafting wealth design strategies around life goals by using a proven planning process coupled with a cost-conscious objective and non-conflicted risk management philosophy.

The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.