An income for life – a lifetime retirement income strategy is what most people want – but are they willing to do what’s required?

For most, if not many, the idea of ‘bucketing’ money into categories – current needs, emergency needs, and future needs – is intuitive. An that’s the ‘secret’ behind having a retirement income for life! It’s not a secret, really; just a common sense strategy for creating a stress-free lifetime retirement income.

We don’t want to take money from one to fund another unless we’re absolutely FORCED to, which we seldom are – yet, that’s what a lifetime retirement income strategy demands.

This likely explains why people generally hate the idea of annuitization, even though retirees routinely say their biggest fear is running out of assets – aha! Assets! Not income?

I’ve known people who’re retired with generous pensions (with cost-of-living adjustments) from the federal government and lived  amazing retirements, living on Florida waterfront property with boats outside their back doors, even though they had only a couple hundred thousand dollars in savings… and loving it. You couldn’t get them to trade those pensions for anything! It was predictable – it would never stop – and they had COLAs built-in!

amazing retirements, living on Florida waterfront property with boats outside their back doors, even though they had only a couple hundred thousand dollars in savings… and loving it. You couldn’t get them to trade those pensions for anything! It was predictable – it would never stop – and they had COLAs built-in!

But, the rest of society seemingly isn’t willing to make the liquidity trade. Research seems to back this up, finding that the size of liquid holdings is directly related to their sense of well-being and satisfaction. Apparently if they can’t achieve their need for future income until they meet their need for current assets, they feel cash-strapped – or they’ll choose retirement solutions that are inferior but psychologically more satisfying..

Mental bucketing comes in two forms:

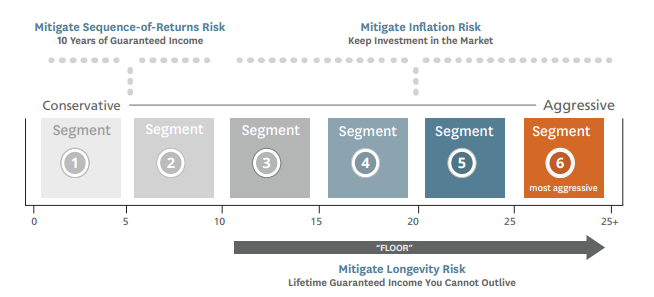

- Time segmentation: Cash, bonds, and stocks are segmented according to time frames. Cash funding near term, laddering bonds for intermediate term and interest-rate risk, and stocks for long-term inflation-hedges.

- Spending segmentation: Using financial tools to put predictability into outlays – Using Social Security and immediate annuities to create an ‘income floor’ for meeting essential expenses, and using portfolio withdrawals throughout the entire retirement period to provide for discretionary expenses.

For many, however, the delineation between essential and discretionary expenses can be fuzzy. When people prioritize their goals, some will classify travel and cable tv as a need, while others will find few needs beyond food, shelter, transportation, medical expenses, etc. And, many neglect to think about the biggest outlay they’ll make during their entire retirement – the annual tax payment to the I.R.S.

The most straightforward solution to longevity risk

For most, the biggest risk is outliving their money. In short, it means running out of income. The straightforward solution is simple: Trading a portion of liquidity to pay cash for a lifetime income – and transferring longevity risk to an insurance company in exchange for an immediate annuity. For many, this is a tough sell because they aren’t willing to give up liquidity of current assets to secure a lifetime income, despite the fact all those retired federal retirees in Florida have been doing it for years – and loving it. And, also despite the fact that an immediate annuity solution is far superior to that of using a variable annuity with a guaranteed lifetime withdrawal benefit.[1]

Not only that, retirees want the potential for an increasing standard of living, as well! Others may have additional legacy goals! Inflation-adjusted immediate annuities are available, but haven’t been too popular due to their lower initial payout

The Hybrid Time-Segmentation™ (HTS) solves many of the issues and may appeal to investors who need a greater degree of certainty for their income strategy.

The HTS strategy puts an ‘income floor’ under the segments – a floor that’s both predictable and expected to last a lifetime, while still preserving short-term liquidity needs and providing for long-term inflation concerns. For example, one popular approach is to use a portion of assets to purchase a ten-year deferred income annuity that provides a lifetime retirement income beginning in year #11. In this way, an additional guaranteed income source is added providing an increased floor as the rest of the portfolio grows for future years.[2] The entire strategy, of course, should coordinate liquidity, security, inflation-protection, and income needs.

If you’d like to learn more – and it’s worth doing – we have a twenty-minute educational video that explains this lifetime retirement income strategy. I think you’ll like it! Grab some coffee, sit back, and learn more here.

Enjoy!

Jim

[1] I must admit my own bias against variable annuities. To me, using the stock portion of a portfolio to purchase a variable annuity is only turning a potential capital gain into taxable income – something that’s made little sense to me, expenses aside.

[2] Using an ‘investment grade’ insurance company is more important, in my view, than simply grabbing for the best-sounding promise of a slick marketing campaign.

If you would like help, of course, we can always visit by phone.

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.