Jim Lorenzen, CFP®, AIF®

People often think investment strategies for retirement security involve a either/or choices, i.e, risky stocks or savings as a zero-sum choice, or active vs. passive investing as an either/or choice; Believe it or not, there’s more than one path to retirement security. Sometimes (often) they can be blended.

Active vs. Passive

For example, low-cost passive investments are attractive simply because it’s widely believed that active managers can’t beat their relevant indexes’ average return on a consistent basis.

For example, low-cost passive investments are attractive simply because it’s widely believed that active managers can’t beat their relevant indexes’ average return on a consistent basis.

That’s probably true, however the argument often ignores the downside protection active management can offer – something index investing doesn’t provide, and something important to investors for retirement security.

Does that mean there’s only one path to financial security… that active is better? No – it’s just different. Sometimes, the extra fee an active manager charges can be worth far more than the alternative downside exposure. Vanguard has created a client education piece about active and index investing that you might find helpful. You can download it here.

Active Institutional Management

Investors with smaller accounts often achieve diversification by investing in mutual funds. While these investors can benefit from the diversification they offer, those with larger accounts can be penalized. The reason is simple: Mutual fund costs don’t scale.

For example, if you have $50,000 invested in a mutual fund that carries a 1.25% expense ratio (just to pick a number), you’re paying $625 a year in annual expenses. Not too bad. But, suppose your investment is $500,000 and you have a basket of mutual funds and all charge about the same 1.25%. Your annual expenses would now total $6,250 per year.

Fund expenses don’t go down as the asset level increases. 1.25%, in our example, would stay 1.25%, regardless of how much your account increases in value. And, those aren’t the only expenses! You can learn about the other hidden expenses in another report, Understanding Mutual Funds, which you can also download instantly, right here.

Institutional money managers – at least all those I use – have fully disclosed fees; but, furthermore, their fee percentage actually declines as the investor’s asset level grows. They can also provide tax-managed benefits not available in mutual funds.

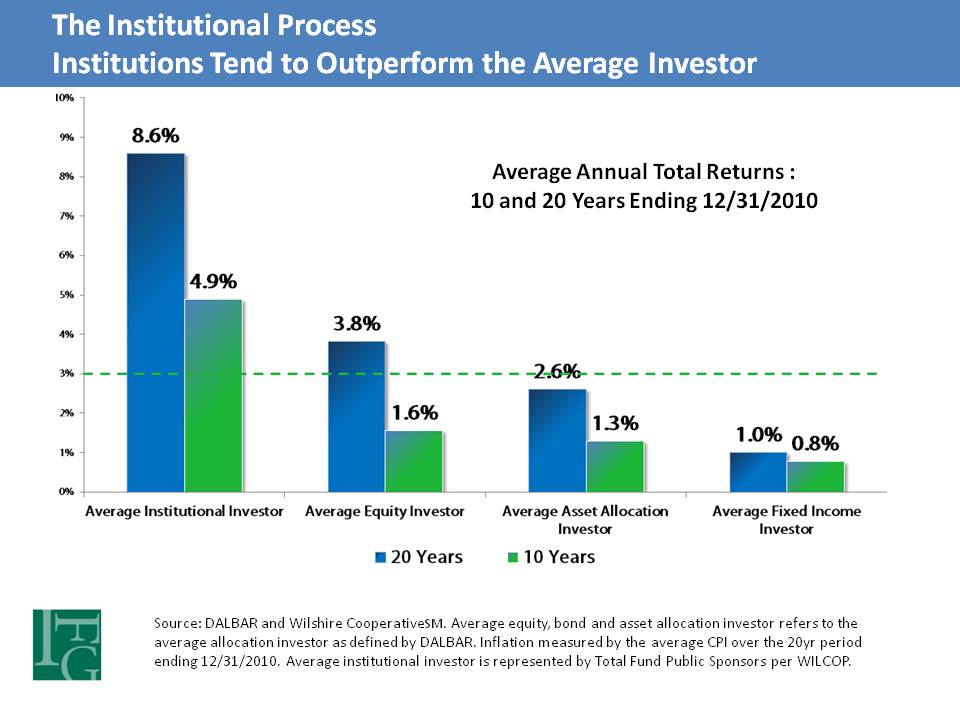

Institutional managers seem to do far better than the individual investor. As you can see from this independent Dalbar study, individual investors didn’t even come close- and the time period for the study included the famous ‘meltdown’ of 2008.

The selection process for institutional managers, of course, is important, if not critical.

The selection process for institutional managers, of course, is important, if not critical.

If you’d like to see the process I have been using here at IFG, you can get it here.

Of course, it’s not an either/or proposition: Blending active institutional management with passive indexes can be quite effective.

It begins with a philosophy.

Do you know your investment philosophy? By the way, “I don’t want to lose money” is not a philosophy; it’s a wish. A philosophy goes deeper – it’s the roadmap that helps you as you go through the investment/manager selection process. IFG’s can be accessed immediately here.

Do you know your investment philosophy? By the way, “I don’t want to lose money” is not a philosophy; it’s a wish. A philosophy goes deeper – it’s the roadmap that helps you as you go through the investment/manager selection process. IFG’s can be accessed immediately here.

Managing the Downside.

There’s a tv commercial sponsored by a mutual fund/insurance complex that asks the question, “Do you know your number?”

While it’s a good question, it doesn’t go far enough. The real question may not be how much you have, but how long it will last! After all, that’s the key to almost everyone’s definition of retirement security.

Longevity risk – “Will I run out of money?”

This is the key issue for most Americans; even those with $1,000,000+ who want to maintain their standard of living, let alone the vast majority of Americans who have less. You might enjoy getting our Money or Income report when you sign-up for the IFG ezine (you can always unsubscribe later). You can get the report here.

What’s right for you is likely no one strategy, but a blend of this – and other strategies not even covered here – that best fits your particular needs and desires.

If you would like help, of course, we can always visit by phone.

Enjoy!

Jim

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® serving private clients since 1991. Jim is Founding Principal of The Independent Financial Group, a registered investment advisor with clients located across the U.S.. He is also licensed for insurance as an independent agent under California license 0C00742. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.