… especially when they’re tied to a plan.

Jim Lorenzen, CFP®, AIF®

Do you know what a systematic Roth conversion is? It’s worth knowing!

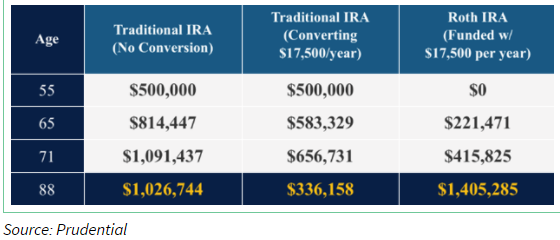

Even at modest growth rates, the results of a systematic Roth conversion can be surprisingly impressive over time. Take a look at this example from Debra Taylor, a tax attorney and advisor in Franklin Lakes, New Jersey, comparing no conversion to systematic conversion. What would the traditional IRA and the Roth IRA (funded with systematic conversions) look like?

Using a modest growth rate of 5% per year over a ten-year period, here are the results beginning with a $500,000 IRA and converting just $17,500 per year.

With no conversion, the traditional IRA has grown to $1,026,744. Not bad, except that all that money doesn’t belong to the IRA owner. Some of it belongs to Uncle Sam – it’s his IRA, too. How much, of course, depends on what tax rates are in effect when withdrawals occur.

Using a ten-year systematic conversion plan instead, that $500,000 IRA ends-up with only $336,158 at the end of 10-years. That means lower required minimum distributions (which impact how much your Social Security is taxable and your Medicare premium amounts) and lower taxes, too. How much lower? Pick a bracket and do the math on both – you’ll likely be surprised.

Instead, using a systematic Roth conversion strategy, those ten annual $17,500 conversions resulted in a tax-free Roth IRA value of $1,405,285! Combined with the traditional IRA, results in two retirement accounts now worth a total of $1,741,443 – that’s $714,699 (70%) more! And, 81% of the owner’s retirement money – the money in the Roth IRA – is tax free!

The best time to begin a strategy like this is after age 59-1/2 and the age when required minimum distributions (RMDs) begin. That age depends on your birth date under the SECURE Act. The age is 72 if born on or after July 1, 1949. It’s 70-1/2 for all others. Once RMDs begin, you can’t use RMDs to fund Roth conversions; you’ll have to take your RMD first, then take the conversion amount. Secondly, the strategy works only if you convert the entire amount and pay any tax due from other funds.

It goes without saying – or maybe it doesn’t – that any strategy should be tied to a solid financial plan that can ‘stress-test’ outcomes and probabilities. Nothing beats experienced and informed guidance.

Jim

————————————

Interested in becoming an IFG client? Why play phone tag? Schedule your 15-minute introductory phone call!

Jim Lorenzen is a CERTIFIED FINANCIAL PLANNER® professional and An Accredited Investment Fiduciary® in his 21st year of private practice as Founding Principal of The Independent Financial Group, a fee-based registered investment advisor with clients located in New York, Florida, and California. He is also licensed for insurance as an independent agent under California license 0C00742. IFG helps specializes in crafting wealth design strategies around life goals by using a proven planning process coupled with a cost-conscious objective and non-conflicted risk management philosophy.

Opinions expressed are those of the author. The Independent Financial Group does not provide legal or tax advice and nothing contained herein should be construed as securities or investment advice, nor an opinion regarding the appropriateness of any investment to the individual reader. The general information provided should not be acted upon without obtaining specific legal, tax, and investment advice from an appropriate licensed professional.